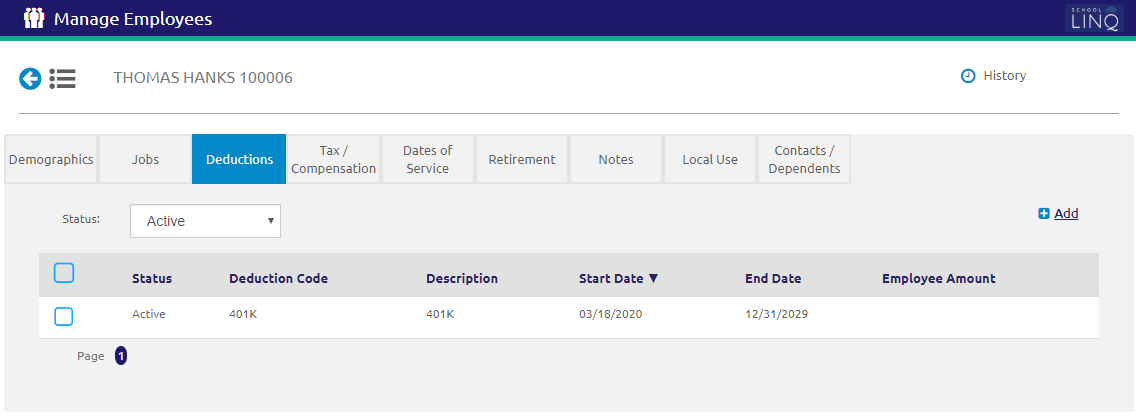

Manage Employees - Deductions Tab

This tab lists the deductions for this employee. These deductions, if active, will apply to all the employee’s jobs that are set to allow deductions.

Search and Edit

-

Select a status from the Status drop-down list to filter deductions.

- If Active or Inactive is selected, check the

boxes to Deactivate or Activate the selected deductions.

boxes to Deactivate or Activate the selected deductions.

- If Active or Inactive is selected, check the

- To view or edit an existing deduction, click on the Deduction row. A form will display below.

- The Active check box means that the deduction is currently enabled. Unchecking the box will temporarily disable the deduction without deleting it.

Add Deduction

- Click the

.png) link. A form will display below.

link. A form will display below.

- Select the type of deduction from the Deduction drop-down list. This list is populated from Deduction Setup.

NOTE: Regular tax deductions such as State and Federal withholding and Social Security do not need to be entered on this screen. They will be applied automatically based on the Subject To section on the employee Jobs tab.

- The Standard and Mandatory fields are read-only.

- If Standard is checked, the deduction amount or percent is the same for everyone.

- If it is unchecked, you will need to enter an Amount or Percentage.

- Enter or select the dates to start and end the deduction using the Calendar feature from the Start Date and End Date fields.

- Enter the maximum amount to be deducted in the Balance Amount and Balance Remaining fields. This is optional.

- The amount is the original Balance Amount.

- The Remaining Balance amount is updated each time the deduction is withheld from the employee’s check.

- The deduction will be stopped when the limit is reached.

- Enter the Amount or Percentage to be deducted per check in the Amount or Percentage fields. One of these is required if the deduction is not checked Standard.

- Check the Apply to Net Pay box for the like the deduction percentage to be calculated against the employee’s net pay, instead of their gross pay.

- Click the

button.

button.

©2021 | EMS LINQ, Inc.

School LINQ Help, updated 01/2021